The "Kepez" NBCO has expanded significantly - PROFIT IS DISCLOSED - REPORT

The results of 2021 were released by "Kepez" NBCO, one of Azerbaijan's top non-bank credit institutions.

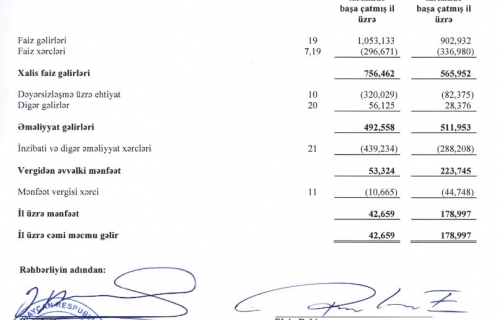

Kepez NBCO's interest revenue climbed by 16.6% in 2021 to 1 million 53 thousand manats, while interest costs fell by 12% to 297 thousand manats.

As a consequence, the firm concluded the year with 756 thousand manats in net interest income (an increase of 33.6%). 320,000 manats of this total have been set aside as an impairment provision. Furthermore, the corporation earned an extra 56,000 manats.

The administrative costs of the "Kepez" NBCO grew by 52% to 439 thousand manats in 2021. As a consequence, the pre-tax profit of the firm was 53 thousand manats. "Kepaz" NBCI ended 2021 with a net profit of 42.7 thousand manats after paying a profit tax of 10.7 thousand manats.

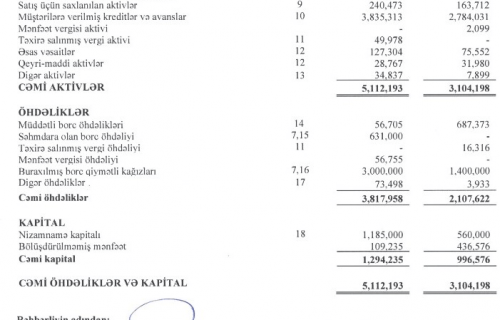

The "Kepez" NBCO expanded fast in 2021. NBCI's assets rose by 2 million manats, or 64%, last year, from 3.1 million to 5.1 million manats.

The significant rise in assets may be attributed to the expansion of the company's loan portfolio as well as an increase in cash.

As a result, the loan portfolio of "Kepez" NBCO expanded by more than one million manats, or 38%, in 2021, from 2.8 million manats to 3.9 million manats.

During the year, the company's financial resources expanded 20 times, from 39 thousand to 795 thousand manats.

The liabilities of "Kepez" NBCO grew by 1.7 million manats in 2021, from 2.1 million to 3.8 million manats.

The issued bonds account for 1.6 million manats of the rise in liabilities; in 2020, "Kepez" NBCO had 1.4 million bonds in circulation; by 2021, this amount had climbed to 3 million manats.

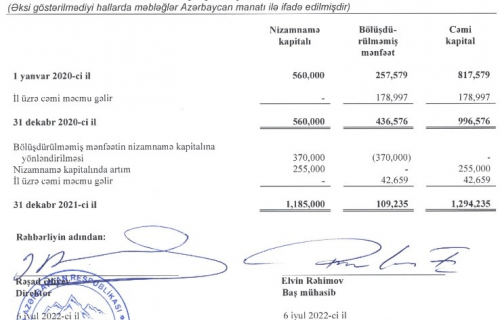

During this time, the company's capital rose by 300 thousand manats, rising from 996 thousand to 1 million 294 thousand manats.